🗣 SL提问: Privateequity

✍️ Ai批改: Private equity refers to investment funds that acquire and restructure companies not publicly traded, with the aim of improving their financial health and operational performance to sell them at a profit、Here's an overview:

What is Private Equity?

Private equity (PE) firms raise capital from various sources, such as pension funds, endowments, and high-net-worth individuals, to invest in private companies or acquire controlling stakes in public companies, taking them private in the process、The goal is to enhance the company's value over time and eventually exit the investment through a sale, IPO, or recapitalization.

How Private Equity Works

1、Fundraising: PE firms collect capital from investors, known as limited partners (LPs), to create a fund.

2、Investment: The PE firm uses the fund to acquire a company or a stake in a company.

3、Value creation: The PE firm works with the company's management to implement strategic and operational improvements, aiming to increase revenue, profitability, and efficiency.

4、Exit: The PE firm sells its stake in the company, usually within 3-7 years, through an IPO, sale to another company, or recapitalization.

Types of Private Equity Investments

1、Leveraged Buyouts (LBOs): Using debt to finance a significant portion of the purchase price, with the expectation of repaying the debt through the company's cash flows.

2、Growth Capital: Investing in growing companies to support expansion, often with a minority stake.

3、Venture Capital: Investing in early-stage companies with high growth potential.

4、Distressed Investing: Investing in companies facing financial difficulties or nearing bankruptcy.

Key Players

1、General Partners (GPs): The PE firms that manage the funds and make investment decisions.

2、Limited Partners (LPs): The investors that provide capital to the PE fund.

3、Portfolio Companies: The companies in which the PE firm invests.

Benefits and Risks

Benefits:

* Can provide growth capital and expertise to companies

* Offers investors access to potentially high returns

Risks:

* High debt levels can lead to financial distress

* Investment horizon can be long, with uncertain exit timing

* Illiquidity: PE investments can be difficult to liquidate quickly

Notable Private Equity Firms

1、Blackstone

2、KKR (Kohlberg Kravis Roberts)

3、Carlyle Group

4、Apollo Global Management

5、Bain Capital

Trends and Outlook

The private equity industry has grown significantly over the years, with assets under management (AUM) exceeding $4 trillion globally、Trends include:

1、Increased focus on ESG (Environmental, Social, and Governance) investing

2、Growing interest in technology and healthcare investments

3、Rise of mega-funds and large-cap buyouts

Keep in mind that this is just a brief overview、If you have specific questions or would like more information on private equity, feel free to ask!

0

IP地址: 10.12.35.141

搜索次数: 285

提问时间: 2025-04-11 11:40:44

❓️ 热门提问:

农银金耀3个月定开债券

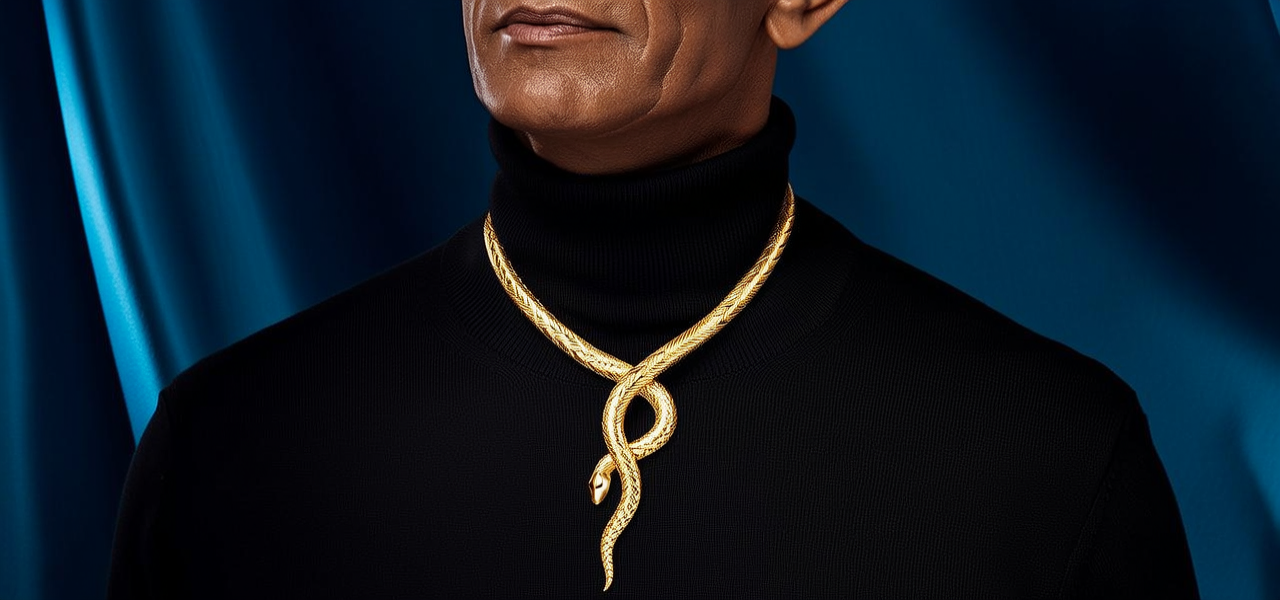

黄金工厂图片

脚链红绳脚链

长盛同盛成长优选(LOF)

广发汇宜一年定期开放债券A

域名查询站长之家

国内外汇保证金即将开放

贵金属分析入门

ipv6静态ip地址怎么申请

短视频 ai

豌豆Ai站群搜索引擎系统

🤝 关于我们:

三乐Ai

作文批改

英语分析

在线翻译

拍照识图

Ai提问

英语培训

本站流量

联系我们

📢 温馨提示:本站所有问答由Ai自动创作,内容仅供参考,若有误差请用“联系”里面信息通知我们人工修改或删除。

👉 技术支持:本站由豌豆Ai提供技术支持,使用的最新版:《豌豆Ai站群搜索引擎系统 V.25.05.20》搭建本站。